Instant liquidity though receivables financing.

Unlock working capital confidentially without notifying debtors.

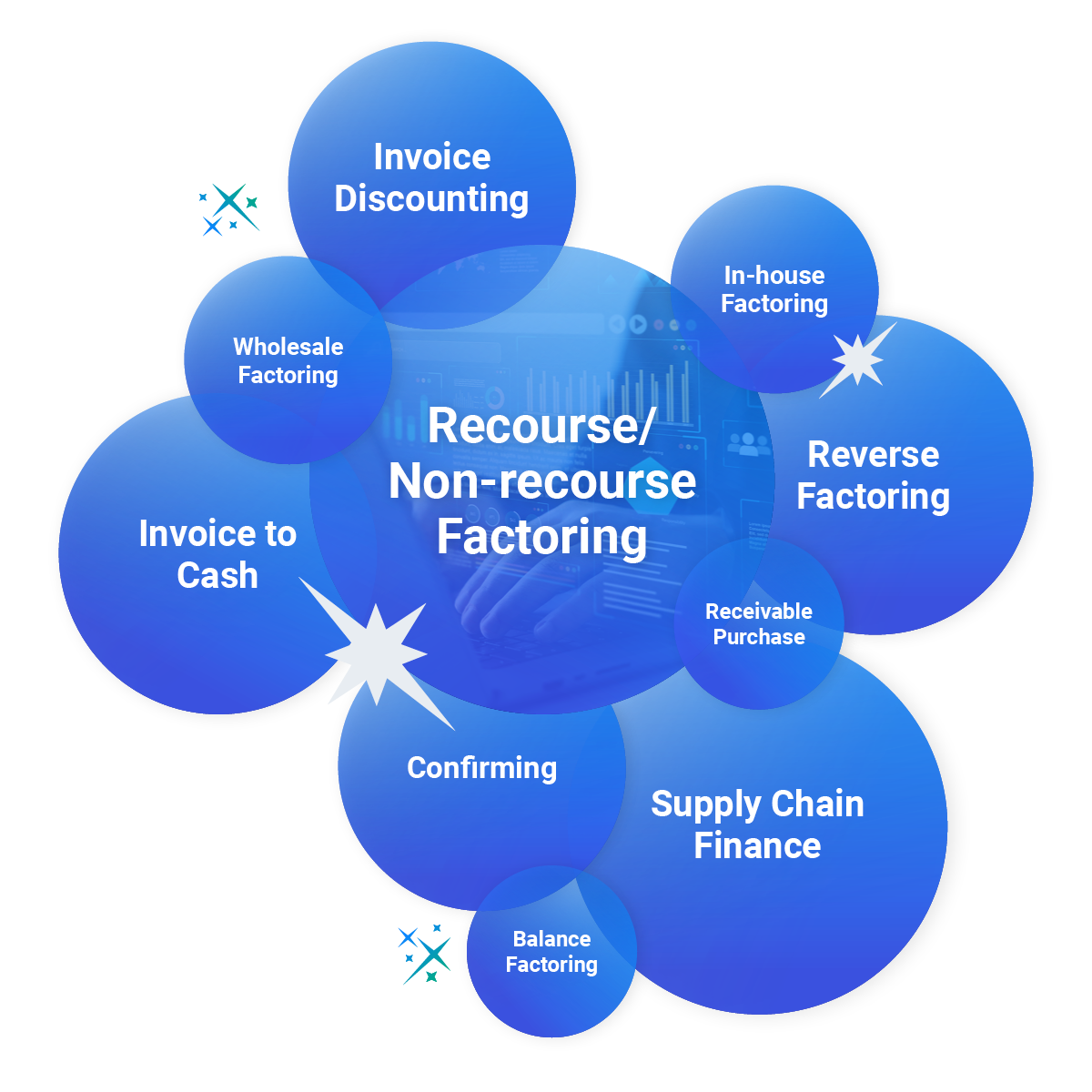

Manage any type of factoring: Recourse/Non-Recourse, International and more.

Early payment solutions to improve liquidity and supplier relationships.

Early payment options with flexible discounting terms.

Supplier financing based on buyer credit ratings.

+ and more: installment loans, leasing, mortgage loans, debt restructuring

Whether you’re operating with legacy systems or modern tools, Comarch Finance Platform integrates effortlessly, allowing you to optimize and extend your current ecosystem without disruption.

Comarch Finance Platform ensures complete oversight and flexibility in managing financing operations across diverse client groups and financial products.

Designed to grow with your business, our modular, cloud-based platform makes it simple to add new financing options, accommodate increased demand, and support business expansion.

The system offers two complementary interfaces. The Client Portal is the pinnacle of simplicity, enabling immediate action for your customers. The Operator Interface is a powerful control center for your team, built for efficient management of complex financial processes. We provide detailed training to ensure your team achieves maximum productivity.

AI intelligence automates workflows, validates data, and performs real-time risk analysis. The result: fewer errors, faster client service, and lower operational costs.

For banks looking to offer diverse financing solutions efficiently and securely.

Perfect for companies that need to manage complex invoice factoring operations with real-time tracking and risk management.

A solution for intermediaries wanting to integrate financing into their platforms, offering their clients modern, seamless financial services.

End-to-end automation from invoice issuance to payment collection, optimizing the entire lifecycle of invoice finance operations.

Support for Supply Chain Finance and Dynamic Discounting models, helping clients access working capital at competitive rates.

Flexibility to deploy on-premise or in the cloud, enabling scalability and ensuring that the platform fits your organization’s needs.

Easily integrate with your existing systems using an open API architecture, ensuring a smooth, unified experience.

Offer your clients a fully online experience, giving them the power to manage their finances on the go with a self-service portal.

A powerful operational core supporting every step — from onboarding and verification to risk management, disbursement and post-financing control.

![]()

Comarch Factoring Core System

![]()

Interest Management

![]()

Monitoring, Audits and Ledger

![]()

Notifications

![]()

Subledger and Compensations

![]()

Customizable Reports

![]()

Client/Supplier Portal

![]()

Cooperation with Insurers

ADMINISTRATIVE CONTROL AND MANAGEMENT

Client Onboarding

![]()

Limits and Contract Configuration

![]()

Counterparties Configuration

![]()

Invoice Acceptance

![]()

Settlements, Monitoring

![]()

Reporting and Dispatch of Reminders

SELF-SERVICE CLIENT EXPERIENCE

Limit Consultation

![]()

Uploading Invoices

![]()

Invoice Approval Process

![]()

Request for financing

![]()

User Management and Reporting

![]()

Connecting with Suppliers/Debtors

![]()

"(…) the new system is rated significantly better than the previous version. Customers are able to create invoice templates for their reporting in a simpler way than before."

ELIZA WYRZYKOWSKA

Head of the Factoring Service Department,

Member of the Management Board, BNP Paribas Faktoring

"(…) once we explored the Comarch Platform and joined the functional workshops, we realized many of our expectations could be met in a smart, efficient way."

EWA GAWROŃSKA-MICUŃ

Head of Strategic Marketing and Product for CEE Region, Country Manager Poland

![]()

Delivering innovative software solutions for Finance, Loyalty, Telecommunications, Healthcare, Public Sector, and Services.

![]()

Fast deployments and continuous improvements powered by dedicated product teams.

![]()

Collaborate closely with clients using Agile methods, co-creating clear roadmaps that address real market needs.

![]()

On-premise, cloud, or hybrid — you choose what fits your business best.

Tell us about your business needs. We will find the perfect solution.